Table of Contents

The potential of AI in the financial services and banking sector is enormous, with projected savings of $447 billion by 2023. As a result, fintech organizations are rapidly adopting AI to enhance their services and maintain a competitive edge in the market. In this blog post, we will explore the transformative impact of artificial intelligence (AI) as organizations are leveraging its potential to enhance efficiency, reduce costs, and improve decision-making processes. Read on to learn the answers to the most asked questions by CEOs regarding the integration of AI into banking and financial operations.

1. What types of data should we be collecting and analyzing to feed our AI systems?

We always advise the financial organizations we are working with to gather information from various sources. Those can range from financial transactions, customer data, market trends to economic indicators.

By 2025, it is projected that 80% of global data will be unstructured, as estimated by IDC. This substantial growth in unstructured data poses both challenges and opportunities for various industries, including the finance sector. Unstructured data includes information from sources like emails, social media, documents, images, and audio recordings, customer relationship management, customer service records, earnings transcripts, tax documents, and surveys. Using analytical techniques and tools can help unlock the value of this data. For example, NLP algorithms can categorize customer feedback, extract key details from earnings transcripts, and identify common themes.

To ensure data accuracy and reliability, organizations should implement the following practices:

Data quality checks: Establish processes to verify and validate data quality, ensuring that it is consistent, complete, and reliable.

Data governance: Implement data governance policies and procedures to ensure data integrity, privacy, and compliance with regulations.

Data cleansing and preprocessing: Use data preprocessing techniques to remove inconsistencies, handle missing values, and normalize the data before feeding it into AI systems.

2. What kind of infrastructure will be required to support our AI initiatives?

Implementing AI initiatives in finance requires a robust infrastructure that can handle the computational demands of AI algorithms and effectively integrate with existing systems. Its requirements will depend on the scale, complexity, and nature of your AI initiatives. Some of the components should cover computing power, data storage, and management, data processing, networking, the ability to integrate with existing systems, and more. It is important to pay attention to the following two components:

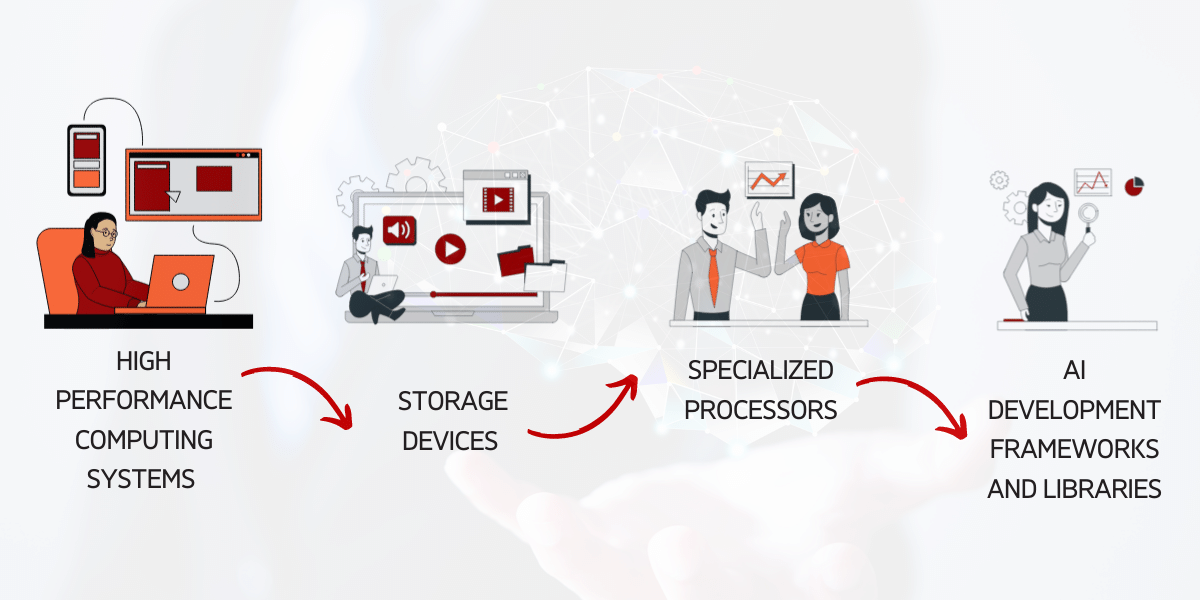

Hardware resources: High-performance computing systems, storage devices, and specialized processors (such as GPUs) are often needed to process and analyze large datasets efficiently.

Software resources: AI development frameworks and libraries, such as TensorFlow and PyTorch, provide the necessary tools and algorithms to build and deploy AI models.

3. How can we integrate said infrastructure into our existing systems?

In this section, we explore the key considerations and steps involved in seamlessly integrating AI infrastructure into existing systems, enabling businesses to harness the full potential of artificial intelligence while leveraging their current technological investments.

Identify use cases

Conduct a thorough assessment of your current IT infrastructure to understand its capabilities, limitations, and potential areas of integration. Identify the specific AI use cases in the financial services industry that align with your business goals.

Define Integration Objectives

Clearly define the objectives and benefits you expect from integrating AI into your existing systems. This will help you prioritize integration efforts and set realistic expectations.

Design a strategy

Develop a clear roadmap for integrating AI solutions. This may involve implementing new software applications, integrating AI algorithms into existing systems, or building custom AI models.

Implement Gradual Rollout

Implement a phased approach to integration to minimize disruption and allow for gradual adoption. Start with pilot projects or non-critical systems before scaling to mission-critical applications.

Consider scalability and interoperability

Ensure that the AI infrastructure can scale to handle increasing data volumes and seamlessly integrate with other systems or applications within the organization.

Ensure Data Integration

Data is the backbone of AI initiatives. Ensure seamless data integration between your AI infrastructure and existing databases or data storage systems. This may involve data migration, data synchronization, or real-time data streaming.

Take into account data security

Implement robust data security measures to protect sensitive financial information. Encryption, access controls, and regular security audits are essential to mitigate the risk of data breaches.

Last, but not least, the organizations should ensure they have the necessary expertise and resources to manage and maintain the AI infrastructure and applications over time. Many businesses find it beneficial to partner with technology experts who can provide the needed expertise and quickly and efficiently onboard the team.

4. How can we measure the ROI of our AI initiatives, and what KPI to track?

Measuring the return on investment (ROI) of AI initiatives requires tracking relevant key performance indicators (KPIs). Some common KPIs for assessing the impact of AI in finance include:

Cost savings: Measure the reduction in operational costs achieved through process automation, improved efficiency, and resource optimization.

Revenue growth: Evaluate the impact of AI initiatives on revenue generation, such as increased cross-selling and upselling opportunities, improved customer acquisition, and enhanced pricing strategies.

Customer satisfaction: Assess customer feedback, sentiment analysis, and customer retention rates to gauge the impact of AI on customer experience and satisfaction.

Efficiency gains: Measure the time saved, productivity improvements, and error reduction achieved through AI automation and intelligent decision-making.

Regular assessments and evaluations should be conducted to ensure that AI systems align with business goals and deliver the expected outcomes. Quantifying the ROI of AI initiatives helps organizations make informed decisions, allocate resources effectively, and prioritize future AI investments.

As an example of how this works, our team developed a predictive analytics model for an international banking group to assess credit risk. The model analyzes borrower behavior data, including payment history, outstanding debt, and credit utilization. Computer Vision models recognize and classify this data, transforming it into valuable insights. By using this model, credit risk assessments are 20% more accurate, leading to improved loan decisions and reduced risk of defaults.

5. How can we balance the benefits of AI with the potential risks and challenges?

Achieving a balanced integration of Artificial Intelligence (AI) while effectively managing its associated challenges requires careful planning and implementation. Here are some essential steps to assure this balance and establish contingency plans:

Data Quality and Privacy

To ensure reliable AI outcomes, prioritize data quality and privacy. Establish robust data governance policies and procedures that maintain data integrity and protect sensitive information. Use data anonymization techniques to safeguard customer data while enabling meaningful insights. Conduct regular audits and assessments to monitor and uphold data security and privacy standards.

Regulations and Compliance

Stay ahead of the constantly evolving regulatory landscape. Keep abreast of the latest industry standards and comply with relevant regulations governing data privacy, financial services, and AI usage. Implement a comprehensive compliance management system to maintain adherence to legal requirements and mitigate potential risks.

Cost and Scalability

Optimize your AI implementation by considering cost-effective solutions. Invest in cloud-based AI platforms to ensure scalability, flexibility, and cost-efficiency. Additionally, explore partnerships with external AI teams or consulting services to tap into expertise without significant overheads. Open-source AI solutions can also offer cost-effective alternatives for specific use cases.

Ethics and Transparency

Infuse ethical principles and guidelines into the design and development of AI systems. Emphasize the importance of transparency by adopting explainable AI solutions, enabling stakeholders to understand and trust AI decisions. Regularly monitor and test AI solutions to identify and address any ethical concerns that may arise.

Talent and Expertise

Cultivate AI expertise within your organization through training and development programs for existing staff. Additionally, seek collaboration with external AI experts or engage with AI development and consulting services companies to leverage specialized knowledge and skills. Collaborating with academic institutions and research centers can foster innovation and knowledge exchange.

Legacy Systems Integration

Integrate legacy systems strategically into your AI implementation. Leverage middleware and integration platforms to bridge the gap between legacy and AI-powered systems, ensuring a seamless transition. Gradually replace legacy systems with new AI-powered alternatives to drive efficiency and innovation.

By following these steps and establishing contingency plans for potential challenges, your organization can harness the full potential of AI while mitigating risks and ensuring long-term success in the rapidly evolving financial landscape.

Conclusion

AI integration is revolutionizing the finance industry, offering significant benefits such as improved efficiency, reduced costs, and enhanced decision-making processes. By exploring common use cases, data requirements, infrastructure considerations, ethical aspects, and security measures, organizations can effectively harness the power of AI while mitigating risks. Embracing AI positions businesses for future success in an ever-evolving financial landscape.

If you require further guidance on AI integration or wish to explore how your organization can benefit from AI, our team is available for an initial consultation session to assess project feasibility and align with your specific needs. Don’t hesitate to reach out and embark on this transformative journey.